RISK OFFICER APPLICATION

1. Overview

A. This application first highlights the risk of the risk officer proposal resulting in no qualified candidates being considered.

B. I then attempt to make the case for my qualification to serve as risk officer through evidence of my views on various projects in the past.

C. Finally, I outline my approach to identifying risks and apply it cursorily to an existing investment of Wonderland.

2. Why this Application is important

Currently if no one were to apply, Sifu would become the Risk Officer of Wonderland. This is unideal as Sifu is already Wonderland’s largest investment-holder, with direct and indirect control of approximately $46.5 million [figure amended following clarification by Sifu] belonging to Wonderland.

To be specific, Sifu is charged with $25m in direct investments in SIFU, the management of $6m in liquidity pools belonging to Wonderland, and $500k in uWu investments. He is also responsible for managing Uwulend, a protocol which Wonderland has deposited approximately $15m of stablecoins into. It is of course worth noting that the Uwulend deposits are only influenced by Sifu to the extent that he has control of the parameters of the smart contracts of Uwulend, which is much less significant than the direct control he has of the previously mentioned investments.

This is only a minor issue as the Risk Officer is not the only person able to or in charge of assessing risk. The Risk Officer does not vote or bring forward their own proposals either. The truer risk is with concentrating investments in Sifu-related projects, rather than having him as a risk officer. However, as Sifu believes in himself (as all individuals ought to do), it is my view that despite his efforts, it would be a challenge for him to be objective about investments in his own projects. He would also have conflicting interests where he is an effective promoter for his projects but also has to present the strongest bear-case for them as Risk Officer. Finally, it would simply be better, both for Sifu who has plenty of existing responsibilities to Wonderland outside his capacity as Risk Officer, as well as for Wonderland which deserves an unconflicted Risk Officer, to have other qualified candidates serve as Risk Officer.

As such, wMEMO holders ought to place weight on having other qualified candidates apply and be voted in as Risk Officer. This application aims to make the case for my qualification.

3. Introduction/Background & experience

I’m an anon personality in the crypto space who has been active in the Wonderland forum and discord and have made substantive contributions. I am doxxed to SkyH and I am a current member of the Workerland discord chat where the internal processes of Wonderland are discussed. I also hold between 3.5-4.5 wMEMO (which I can increase to 5 wMEMO in the event that I am made RO). I will try to highlight my knowledge of DeFi through documented evidence of my views at certain times, about certain protocols.

Before proceeding, I should make clear that I do not work in finance or have any licenses to provide financial advice. My knowledge of financial concepts, economics, and DeFi has been hard-earned through my own experience in crypto and I hope to provide a more evidence-based illustration of my knowledge of both protocols and protocol risk below.

FIRST ILLUSTRATION

I initiated and brought to completion the proposal to purchase 12.5m of GLP. I also brought forward a proposal to consider the purchase of two other tokens which include significant sections detailing risk.

These proposals primarily demonstrate my skill in understanding not only the risk profile of DeFi protocols but the protocols themselves. As there are multiple proposals with significant sections on risk, I will not repeat them here – instead, if interested please take the time to have a read or glance through the proposals to see my thought process and explanation of the risks of the included protocols.

On a secondary note, the proposal also indicates that I had good sense in choosing particular investments at a time when the market had just crashed. This is relevant in my application as it demonstrates a useful accessory skill that I have, in that I could arrive at an understanding of not only the risks but of the risk : reward of those tokens (I chose the tokens not due to low risk but due to asymmetric risk when compared to the rewards) – this is useful in the RO position as it allows me to reach a contextualized view of risks.

SECOND ILLUSTRATION

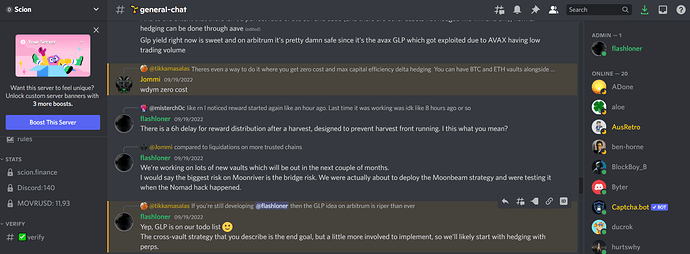

Quite early on, I brought forward ideas to GMX about how to create delta-neutral GLP vaults with low or zero funding fees.

This is a complex model which a notable and well-known DeFi protocol (which I cannot name for now) has now independently arrived at on their own and are working on developing as a composable layer on top of GMX. I had conversations with the treasury advisor of that protocol and offered my views to aid, as far as was possible, in firming up the model.

Another protocol focusing on delta-neutral strategies, Scion.Finance, is also currently working on deploying this strategy and for this, I can provide some evidence below.

The point of mentioning this is to show my fluency in complex models used in the DeFi space, as well as the constant critical thinking that I apply as I think about the models of DeFi protocols - in this case, I came up with the delta-neutral strategy proposal after thinking about how GMX’s GLP model could be improved, and then iterating ideas to arrive at this delta-neutral strategy as can be seen from the forum post and how it evolved.

This is the kind of thinking which I aim to employ as Risk Officer to critically evaluate models used by DeFi protocols.

THIRD ILLUSTRATION

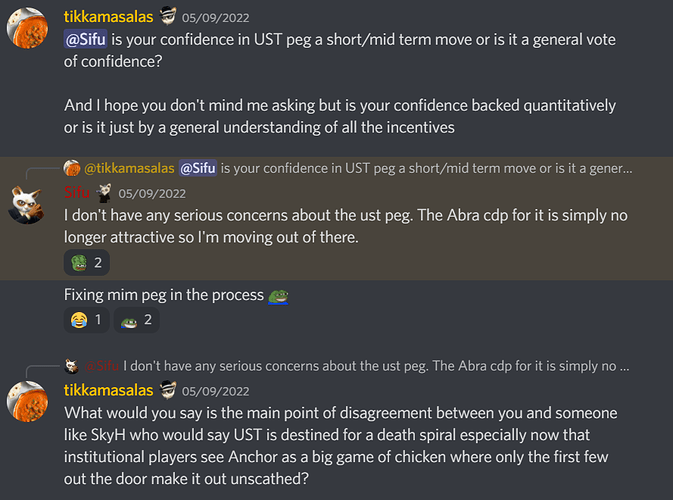

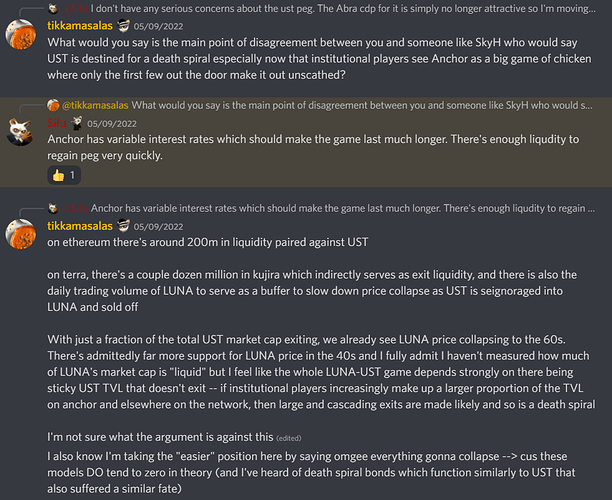

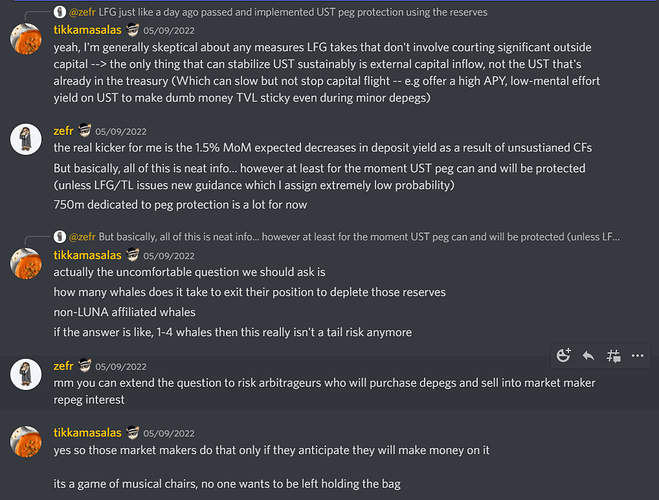

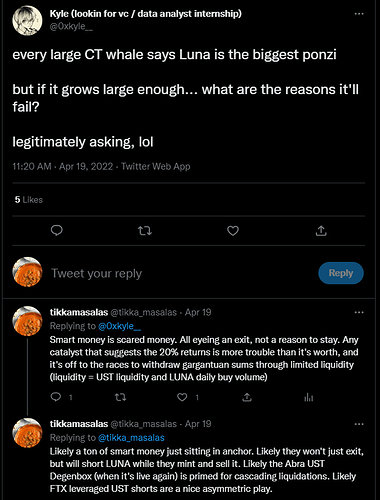

I consistently made arguments against the UST peg holding in the weeks prior to its collapse. My arguments are best documented on the sifuvision discord here as I was trying to understand whether Sifu had information that I did not, regarding why he held large quantities of UST.

Before reading the excerpts, note that I do regret that this illustration unnecessarily draws a comparison to Sifu’s views – I intend only to have my own thought process put on display here for the consideration of readers.

4. Risk Assessment Framework

When evaluating a given protocol, I consider their tokenomics, team, complexity/track-record of smart contracts, among other risks. Read my past wonderland forum proposals for written examples of my thought process on evaluating such risks.

My framework for thinking about projects and the risks inherent in them starts with a consideration of their tokenomics and the incentives created by the project, and then projecting what the end-state of the system is. This framework is inherently bearish because it always envisions the end-state equilibrium reached by the present incentives of a project. An end-state equilibrium usually implies stagnation of some kind, which is usually bearish.

One example of how this thinking is applied can involve a consideration of Olympus where OHM trades above backing at the starting point. The price of OHM will eventually arrive at an equilibrium price near or equal to its liquid backing price as bought-OHM and OHM rebases are sold into protocol-owned-liquidity. The price would stay near liquid backing simply because the protocol could buy back its tokens below backing to generate a profit (assuming there are reasons for them to care about increasing backing per OHM).

It is useful to apply this bearish model because it then enables a consideration of how a protocol could avoid the bearish outcome, and guides the kind of questions that need to be asked to assess how the protocol intends to avoid this outcome.

For a more current example, consider Uwulend – uWu-ETH LP Lockers are betting that the fees from locking will exceed the loss of value of uWu as uWu is dumped into the LP. This is generally a poor bet – depositers on the platform will continue to farm uWu at a rapid rate so long as the cost of looping (the fees to LP lockers) are less than the uWu rewards (the cost to the LP lockers). I.e, LP lockers are signing up to provide free money to depositors and loopers who dump their uWu rewards.

This is not the whole story as data so far apparently shows depositers are playing the game irrationally by locking their uWu instead of dumping it (which is not unexpected especially for a new crypto casino – irrational behaviour is characteristic of retail defi users, as seen from how tokens like OHM could climb to such a high multiple of backing, or how UST was seen as a safe or low-risk investment despite its death spiral mechanic being clearly laid out).

Further, Uwulend could (and likely is going to) introduce new revenue sources or different mechanics which move the model away from one where locked LPs subsidize the protocol’s growth or early LPs are properly compensated during later periods where the project has succeeded and users deposit or borrow not only to dump uWu rewards, but to actually use the project. Uwulend is also backed by a well-capitalized individual who can tap into his own funds, funds from Sifuvision depositers (including Wonderland) and also funds invested by outside investors (now including Wonderland as well) to keep the project going by supporting the value of uWu.

These facts do not, however, eliminate the risk of the current tokenomics and current state of the protocol to LP lockers, and this is precisely the kind of risk which I aim to make clear to Wonderland if I serve as Risk Officer.

Note: I am not aware of whether this risk was explicitly mentioned by Sifu to our treasury team though there is a decent chance he did mention it. As I have repeated in this post, I am not aiming for a comparison to Sifu so whether he did or not is not important – what’s more important is that the reader can see I have the understanding of DeFi and tokenomics required to bring up all pertinent risks to the treasury team.

5. Conclusion

A. I argued that it is advantageous to have an unconflicted and qualified Risk Officer.

B. I then made my case for why I believe myself to be qualified by bringing up evidence of my views on multiple projects, technical proposals I made, and by providing a partial analysis of an existing investment of Wonderland.

C. I am willing to be doxxed to Alice or an appropriate senior member of the team, and am already doxxed to the prior treasury manager, SkyH.

D. I hope to address any further questions in the comments.