Background:

-

With SkyH announcing his general intent to lapse in his role as Treasury Manager after the completion of his term, and without any clear candidates for the position (someone doxxed, trustworthy, experienced, and willing to expose themselves to the risk of working for an unregulated DeFi project), the community should at the very least prepare to operate without a qualified Treasury Manager.

-

As such, we have to consider relying on governance proposals and voting power to make reasonable decisions about how to invest its funds. Arguably, SkyH, Sifu, Mods, or any member of the community could also post their own proposals if and when they wish to do so, and the community can judge them based on their proposals as well as their trust or other factors (though the community should always exercise due care rather than acting on blind faith).

-

Of course, there are some issues with democratic investment. Directional, short term trading is not as feasible through such a cumbersome voting-process, and neither is investment in illiquid projects which would pump as soon as word gets out that Wonderland is considering investing in them.

-

This proposal will preliminarily provide a method to avoid some of these pitfalls. No vote is needed to enact this method/process as it is merely a framework for how to use existing governance power, rather than a brand new proposal.

-

After introducing the framework, this proposal will then suggest three investable yield-generating and bear-market-ready projects/tokens ($GLP on GMX, $TEMPLE and $GNS), for the community to vote on authorizing and proceeding with investing in on the secondary market. I personally have positions in all three investments, so consider this when reading my proposal, and do your own due diligence before voting. The snapshot, if there is one, will allow the choice to select zero, one, two or all three investments for approval by voters.

Process for executing Community-Investments (Preliminary Framework):

-

If you wish to read about the three investments being proposed, skip ahead. This section deals with a framework for how the DAO can invest without being frontrun, taking on other unreasonable risk, and leaving certain discretionary power to the multisig.

-

Any member can post a DAO Discussion on authorizing and proposing one or more potential investments. Rather than a vote dictating the exact quantity of investment as well as the time-frame for investment, the vote should be merely to authorize and signal interest in particular investments, and the multisig then retains some discretion over the finer details of execution.

-

The vote can also contain certain guidelines to better inform the multisig, but by generally leaving discretion up to the multisig, it masks the investment’s timeline and price-impact, making DAO investments harder to frontrun.

-

Once it goes through the usual RFC, WIP and snapshot stages, if voted in the affirmative, the proposal passes and it is up to the multi-sig to confer privately on the finer details and timeline (the original poster of the proposal can also be included in such a discussion if this aids the multisig in making an informed plan of attack).

-

In order for the DAO’s voting power to have meaningful effect, the multisig should generally heed the DAO’s decisions unless there are strong reasons to believe that investment in certain projects would be likely to be detrimental to the backing/wMEMO. However, such decisions must ultimately be explained to the DAO rather than leaving the DAO wondering when it will be executed.

-

Consider the following illustrations as examples of how the process might work for different kinds of investments:

ILLUSTRATION ONE: Investing in $GLP on the GMX platform

Wonderland DAO votes in a snapshot in the affirmative, to deploy some of its capital to yield farming $GLP on GMX, where $GLP is akin to tricrypto, with different mechanism for generating yield, as well as different smart contract and platform risk.

Frontrun Risk: There is little to no slippage when minting $GLP, and there is little scope for such a transaction being frontrun.

Investment Risk: Given the general risk-profile of GMX’s founders, smart contracts, and $GLP’s track record, there is likely to be little reason to believe the investment would cause more harm than say, holding BTC and ETH. One potential argument against this lies with the notion that if BTC/ETH/AVAX fall in value at the same time as a grey swan event where several large shorts are closed on GMX, $GLP could lose significant value.

Multisig Discretion: If the risks are not deemed significant enough to warrant defying or delaying the DAO vote, the multisig should proceed to work out the details of executing the investment. If the multisig makes a decision here that is deemed “unreasonable”, short of changing the multisig the DAO has little recourse – but this is applicable to any area where the multisig has some discretion.

ILLUSTRATION TWO: Investing in $rDPX on the Dopex platform

Wonderland DAO votes in a snapshot in the affirmative, to take a position in $rDPX, a token from the Dopex ecosystem on Arbitrum network. $rDPX is a highly speculative investment in the future of Dopex and Dopex’s future native-stablecoin, synthetic assets and options-strategies. Any such proposal to invest in $rDPX should carry with it significant analysis into the various risks associated with Dopex and $rDPX’s future, in order to equip both voters and the multisig with sufficient facts to do further research and make a final decision.

Frontrun Risk: There is significant risk of being frontrun given that liquidity for $rDPX is on-chain and lower than $10m. If Wonderland transfers some of its funds to Arbitrum without obfuscating the transaction through a CEX, frontrunners could drive the price of $rDPX up before Wonderland takes a position in it. This can be somewhat avoided through (1) the multisig executing the purchase on a private-timeline (2) through a private EOA (3) at a preset price-range and (4) by DCAing, similar to how SkyH’s buyback bot operates. Alternatively, an OTC transaction with Dopex or large holders of $rDPX can be arranged as well, at a fairly negotiated price.

Investment Risk: Given the speculative nature of $rDPX as well as the relative nascence of Dopex and of on-chain options platforms in general, the investment carries significant risk. However, Wonderland is not new to investing in startups, and this risk should simply be factored in to moderating the size of the position in $rDPX as well as the target price-range. This risk should also warrant closer analysis of the team, past performance, market conditions, etcetera.

Multisig Discretion: Similar to the previous illustration, upon considering the above risks as well as any other salient risks, the Multisig should work out the details of execution.

THREE MINI-ILLUSTRATIONS: Multisig Discretion

- The community votes in the affirmative on investing in XYZ token, but by the time the vote is completed, the stated reasons for investment have faded or market conditions have changed significantly. The multisig should take such changes into account and if it decides not to invest, or to delay investment by a significant or unknown period of time (e.g: until we are out of ‘bear market’), it must inform the DAO of this decision and the reasons for the decision as soon as possible.

- The community votes against investing in ABC token, but the multisig was privately bullish on investing in it. Without a subsequent vote, the multisig should not defy the will of the DAO by investing in ABC token. Further, if a proposal is taking place (the proposal has reached RFC or WIP stage) but the snapshot has not yet started or completed, the multisig should defer its investment decisions that involve the vote until after the vote is completed. Reasonably, if the snapshot is at least 2-4 days in and shows overwhelming support for the investment, the multisig would not be out of order if it proceeded to invest early – this is especially the case if it helps avoid being front-run by those waiting for the snapshot to end.

- A wMEMO whale votes at the last second of a snapshot to approve an investment in a token that is likely illiquid, has a poor risk-reward, or otherwise. The multisig should consider any and all risks that the investment has in deciding whether it is likely to damage the value of Wonderland’s treasury or backing per wMEMO, either by locking up assets, losing market value, or taking on excessive risk (e.g, swapping USDC for Neutrino USD – arguably this swap does not lose any market value or lock up any assets, but there are risks associated with the peg of USDN that cannot be ignored). However, just because a whale voted on a proposal does not make it less legitimate – this illustration merely points out a situation where whale manipulation is possibly occurring, and this possibility is for the multisig to factor into their decision. As always, any decision to defy the outcome of a snapshot must be reasonable and explained in full to the DAO.

THREE INVESTMENTS THAT WONDERLAND DAO SHOULD CONSIDER

Investing in $GLP on GMX

-

Overview: Wonderland should mint $GLP on GMX (on Avalanche) to earn a sustainable, considerable yield paid out mostly in AVAX. Wonderland already has a position in BTC and USDC, and $GLP is largely comprised of BTC, ETH, AVAX and USDC (volatile:stable ratio is 45:55 right now, and has generally fluctuated around this ratio historically). $GLP is also demonstrably safe, and its risks are discussed below.

-

Suggested position-size: Given that Wonderland has around 15m USD in BTC, it would be reasonable for some fraction of our BTC exposure to be ported over to $GLP instead (reduction of 1m in BTC matched by taking up a position of 2m in $GLP, approximately). Given that $GLP is yield-bearing, it is attractive as a substitute for spot-BTC, and a position of 5-10m in $GLP would be reasonable as it would be possible to attain this without changing our existing exposure to L1s. This investment should take place after redemption, for convenience of our TM and multisig (and in any case, a vote on this proposal will extend past redemption).

-

What are GMX and $GLP: GMX is a popular is a leveraged trading and spot trading platform on Arbitrum and Avalanche. The following medium article contains a thorough breakdown of GMX and its liquidity token, $GLP - Four Perps of the Apocalypse - by Pickle - alpha please. Briefly, however, $GLP on Avalanche is akin to an LP position comprised of the above mentioned assets where 70% of the platform’s trading fees accrue to $GLP. Due to high trading volumes, GMX has historically been able to pay out a 15-30% APR in AVAX, with some additional percentage points paid out in illiquid ‘esGMX’ tokens, which take one year to vest into GMX and which can then be sold.

-

Risk Profile: The first risk of $GLP is smart contract risk. The smart contracts on GMX have been audited and currently contain a TVL greater than $USD 200m across Avalanche and Arbitrum. They have not been exploited in the past despite the great incentive that exists to do so. Further, given the popularity of GMX as a platform, several commentators have examined GMX’s smart contracts and have generally not found exploits. One such piece of mature commentary, and the corresponding response by GMX’s main dev can be found here: https://twitter.com/xdev_10/status/1532167238496976898

-

The second risk of $GLP is that $GLP act as “the house” where GLP holders win when traders lose, and vice versa. Leveraged traders have consistently been unprofitable on the GMX platform. However, there is a foreseeable risk that in a grey swan event, traders win en-masse and $GLP holders experience depreciation of $GLP. This risk is slightly mitigated in a bull-market where traders win on longs as the BTC, ETH and AVAX component of $GLP would also appreciate and slightly offset trader-winnings. This risk is exacerbated in bear-markets where traders win on shorts as $GLP loses value both from traders winning and from the depreciation of BTC, AVAX and ETH.

- Despite the risk of acting as the house, $GLP is generally safe as it has been tested in bull, crab and bear markets. Notably, the recent drawdown in crypto markets have been even more extreme than even the COVID crash of 2020 by an order of magnitude – despite this, the GLP LP model has not experienced significant issue. Further, its smart contract risk can be stomached given its unexploited TVL of >200m over the past year, its audit, its bug bounty, and its community-testing.

Investing in $TEMPLE

-

Overview: Wonderland should acquire a position in $TEMPLE, the governance token of a fellow OHM-fork, TempleDAO, on Ethereum network. Investing in $TEMPLE enables Wonderland to earn considerable yields, as well as achieve the secondary outcome of speculating on the RFV redemption of $TEMPLE. The yield from $TEMPLE is relatively safe and is more attractive than comparable alternatives, as will be discussed below. The yield from $TEMPLE can range from 10-30%. Further appreciation can occur over time as well, either through redemption or capital appreciation as buyers better understand the low-risk leveraged yield that $TEMPLE offers.

-

Suggested position-size: Given the relatively minimal downside risk due to the price-floor, the consistent source of yield that $TEMPLE provides and the potential for both capital appreciation from revenue-share based market-interest and treasury-redemption, $TEMPLE is an attractive investment. However, there is some irreducible risk from any complex DeFi product, hence I suggest a position size no greater than 5% of Wonderland’s treasury where $TEMPLE is acquired under 80 cents for maximum value to Wonderland. Final discretion regarding position size, price-targets and timelines for acquisition remain with the Wonderland multisig.

-

What are TempleDAO and $TEMPLE: As an OHM-fork, TempleDAO has accumulated a $FRAX treasury of greater than 130m. TempleDAO is similar to Wonderland in a few respects. Firstly, $TEMPLE trades at 65-75 cents despite its RFV being >$1.10 in FRAX alone. TempleDAO protects the 65 cent price floor, hence limiting risk considerably while also increasing $TEMPLE backing whenever holders sell into the price floor, similar to how Wonderland buybacks operate. Second, TempleDAO, similar to Wonderland, offers revenue sharing through their vaults. Such revenue share is generated from the FRAX3CRV convex pool which renders the yield relatively safe, as FRAX and Convex itself are safe. Yields paid out in CVX, CRV and FXS may lose value in a bear market, but this to be expected. $TEMPLE also generates yield from its own $TEMPLE-FRAX pool which attains a considerable yield-boost from directing veFXS voting power to its own FRAX gauge.

-

Why investing in $TEMPLE is superior to investing in its constituent sources of yield: It is more attractive to invest in such yields through $TEMPLE rather than directly investing in the aforementioned Convex and FRAX LPs as the sub-RFV value of $TEMPLE creates free 1.7x leverage without any liquidation risk – as each $TEMPLE represents 1.7x its own value in FRAX, this creates risk-free leverage when the underlying assets generate a yield paid out to the undervalued $TEMPLE. This also creates a strong possibility for capital appreciation when the market better understands the free leverage offered on $TEMPLE at sub-RFV prices.

-

Potential for redemption: TempleDAO has officially communicated an intent to consider redemption of the TempleDAO treasury 3 months from now. The redemption details are very unclear at this point but will apparently be expounded on soon based on the latter-linked vault Q&A article – the gist of redemption so far is captured in the extract below.

-

Risk Profile: The first risk involved here is smart contract risk. Smart contract risk here is not something to brush over as TempleDAO earns its yield by using convex smart contracts, FRAX smart contracts and their own smart contracts built on top of those. Though the underlying convex and FRAX contracts are relatively battle-tested, well-known and have secured large TVLs over the past year, TempleDAO’s own vault smart contract is newer. Nonetheless, the TempleDAO team have not suffered exploits to this point, and have waited for an audit of their core contracts before releasing their vault product. Currently, the vault contract contains >40m in TVL.

-

The second risk is multisig risk. Their treasury is operated by 2/3 multisig of pseudo-anon multisigners. So far, the TempleDAO multisig/team have not deviated from their stated intentions or rugged, and have delivered on most stated roadmap plans. It is still worth noting that there are some accusations that TempleDAO pays their devs too highly (based on existing info, its estimated between 300-900k a year per dev though one would have to dig through past transactions to figure out the exact figure). I personally do know that the multisig is doxxed to specific members of the crypto community who are generally considered by most to be trustworthy, which makes it less likely they can or will act maliciously. This pseudo-anonymous

-

When Wonderland invests in any project (or indeed when anyone invests in Wonderland), the multisig and smart contract risks are among the main risks. In the case of $TEMPLE, measures such as audits and being doxxed within Crypto Twitter exist to mitigate such risks. Nonetheless, a position in $TEMPLE is worthwhile.

Investing in $GNS

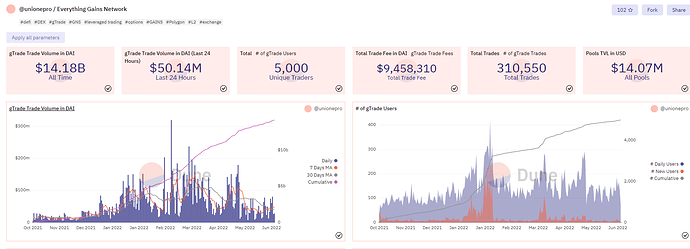

- Overview: Wonderland should acquire $GNS tokens to stake on Gains Network on polygon, as well as provide DAI liquidity on Gains Network to acquire a share of the trading fees (similar to $GLP on GMX). Wonderland should also stake DAI on Gains Network. These investments allow Wonderland to own a stake in a competitor-platform to GMX which has a market cap of <25m, but which has generated near 10m in revenue in the last 8 months. This stake will pay out fee-based APR to both the GNS-DAI LP and the DAI vault deposit. APRs are based on current TVLs and the past 7 days of trading volume, and can be viewed here.

-

Suggested position-size: There are two positions that Wonderland should consider taking on Gains Network. Firstly, given the low liquidity for $GNS of only around <5m, a large position is not possible. Instead, it would be possible to DCA into a position over a long period of time, with the goal of attaining a position that I suggest be no larger than 0.5% of the portfolio. This $GNS should be LPed with DAI and staked on Gains Network to benefit from trading fees. More immediately, Wonderland can stake DAI in the DAI vault without liquidity limitations or the frontrunning issues associated with buying tokens from an LP. I suggest no more than 1.5-2% of the portfolio should be staked in the DAI vault. The reasons for the suggested limitations is due to the small size of Gains Network’s liquidity and platform, though in terms of risk there are a number of reasons to view GNS as having a similar risk profile to $GLP (not unreasonably risky).

-

What are Gains Network and $GNS: Gains Network is a leveraged trading platform on polygon with >14bn in cumulative trading volume, doing 30-80m of trading volume a day for the past month (in bearish conditions). The article detailing GMX above similarly provides a detailed look at Gains Network and the $GNS token. Similar to GMX, a large proportion of trading fees are distributed to the community. However, unlike GMX, Gains Network was not funded by VCs, hence a portion of fees also go to a dev fund which is used to compensate the Dev team. As detailed in the image below, revenue is distributed to the community through the funding of a governance fund as well as by paying GNS-DAI LPers, DAI vault stakers and community-run liquidation bots. When traders lose, the DAI vault is filled with excess DAI, and when the vault exceeds 130% of its deposited balance, all excess DAI beyond that is used to buyback and burn GNS. The below image details the most recent month’s profit distribution.

-

Gains Network has had its smart contracts audited 7 times by Certik, attaining high scores on security each time. These audits speak to smart contract risk as well as the rate of development on the platform whereby several versions of the platform have been iterated in the past year. Currently there are 7 developers/marketing staff working on Gains Network with a detailed roadmap for expansion and feature upgrades. Nearly all past items on previous editions of the GNS roadmap have been fulfilled per schedule, which is itself no easy feat. As there are significant funds in the dev-fund from previous months of fee-revenue, GNS has a lengthy runway to keep building in the bear market, especially as GNS remains profitable from continued trading volume.

-

Future developments for GNS: Per its roadmap, the platform will introduce a funding rate to incentivize longs and shorts to be balanced, and this will also enable all pairs to have a minimum leverage of 2x (previously the minimum was 5x) – in turn, this enables a broader audience of traders to trade on GNS. Besides already having guaranteed stop-losses (if I set a $20k stoploss on a BTC long, regardless of polygon network conditions my stoploss will be fulfilled), guaranteed take-profit and limit-orders will also be making their way to GNS to allow GNS to be one of the first decentralized applications that has comparable execution finality to CEXs. GNS will also be launched on Arbitrum in coming months, which will allow GNS to expand to another Ethereum L2 which has significant DeFi TVL and activity.

-

Recent Events: Gains underwent some losses due to LUNA and AXS shorts on the platform draining the DAI vault of 25% of its DAI. The mechanism used to refill the DAI vault also caused the value of GNS to take a dive as the mechanism involved minting new GNS and selling it into the GNS-DAI LP to obtain DAI to refill the vault. These mechanisms were not sustainable and the dev team has since made several systemic changes to the product tokenomics with more to come, in order to better manage the listing-risk and DAI vault mechanics on the platform. These changes are, detailed here. It is notable that despite both the drastic LUNA and AXS losses occurring back to back, the platform only suffered a 25% hit to their DAI liquidity which has since nearly completely recovered in a month.

-

Gains has adapted significantly. Just to list a few key changes, the platform delisted many of its unprofitable alt pairs, increased the DAI vault’s share of fee revenue to incentivize new deposits (which are now at an all time high), and has discontinued the GNS mint-mechanism. The DAI Vault will also incorporate a 30% buffer to protect DAI stakers from future tail risk events. The coming funding rate will also provide greater balance to the positions on Gains, further lowering the risk of asymmetric and disproportionate winning by traders.

-

Risk Profile: In terms of Smart contract risk, GNS has not yet been exploited and it has already stated above that GNS has undergone 7 successful audits by Certik, a reputed smart contract auditor. Similar to GLP, there is a risk of traders winning overwhelmingly and this risk has in fact materialized for GNS last month – however, given their adaptations and changes as well as their rapid liquidity recovery, the risk of traders winning disproportionately has become far less extreme.

-

There is one feature of the DAI vault in particular that should be mentioned as a risk, which is that there is a 4 day time-lock on DAI withdrawals from the vault to prevent bankruns. Only 25% of any individual’s total deposit can be withdrawn per 24 hours. In order for Wonderland to circumvent this time-lock, it is possible for Wonderland to deposit a large sum of DAI and withdraw 1/4 each day, for 3 days, allowing the remaining 1/4 to be withdrawn in one-shot, at any time in the future without the time-lock restricting Wonderland.

-

There is also market risk involved as GNS is a volatile token, and significantly more GNS exists and is held than the GNS-DAI LP can support – if large holders were to exit, the price of GNS could tank. This makes it less likely that Wonderland could withdraw quickly. However, if approaching GNS as a secondary-market VC investment, short term liquidity is less important than future growth. Further, given the cashflow generated from fees, it is not the future price but the total value extracted from the purchase that matters in the long run.

Wonderland should authorize investments in one or more of the following:

- GLP on GMX

- TEMPLE tokens staked in the TEMPLE vault

- GNS tokens and DAI stable deposits on Gains Network

- None of the above