That sounds related to the liquidation fee, it’s 10% for WMEMO on abracadabra

I feel bad for the people man. Maybe as a DAO we should vote for them to atleast get some sort of money back? It should not be a YES/NO binary option but maybe a sliding scale from 1/4-1/2 the value of what they lost. Obviously I am hesitant to pay it all back.

You are welcome to send them free money.

It had nothing to do with the liquidation fee. I leveraged after we hit the bottom

As in, after the big red candle. The price was only going up after that point. Then I got liquidated because the abracadabra oracle registered the red candle with a delay. Red candle happened at 21.10, i got liquidated at 21.24. I am far from the only one who got liquidated by buying the dip. This is just sad

Maybe there was a delay in the sale of your liquidation by a bot or it went into a queue before transaction was completed

Got it, in that case you should bring it up in abracadabra’s forum. Wonderland’s DAO has no relation with that

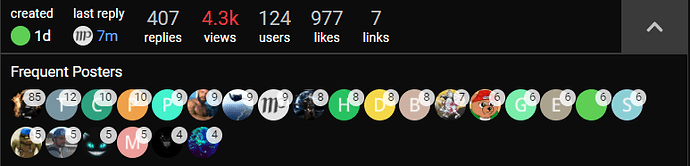

To be fair you currently have 85 out of 407 replies (21%-ish). The next one after you has 12 post (3%-ish).

You might not be “spamming”, but you have clearly re-hashed everything you had to say multiple time.

Even the post creator isn’t even close.

A lot of people agree with you, a lot don’t at this point this conversation is more of a place for people to vent and going in circle than anything else. The RFC has been sent for approval, feedback can be provided if/when posted.

Although I understand the votes are kinda weird given those that were liquidated don’t have voting power anymore. Or not as much.

From day one, we were EXPLICITLY TOLD that the backing price was in no way, shape or form a “floor price”. My heart goes out to those who were liquidated but I was able to deleverage not once but TWICE during the crash. Yes, I had to raise my swap tolerance to approx 20% but I was able to do it. If people wanted to wait till the last minute to try and get out…thats on them. If anything, take it up with AVAX and try getting money from them for their network being congested but in no means should our treasury be used to bail out people who failed to read the docs/white pages and didn’t know enough about leverage trading to get out way ahead of the crash. It sucks but its investing. Defi is decentralized finance - theres no “bail outs” for people who shouldn’t have been leverage trading in the first place. Sorry to sound so harsh but consider it a lesson learned.

On another note, the backing price moved with price action. So if someone set a liquidation price below the backing price thats just crazy bc the backing price was constantly moving (up AND down).

If you can’t read properly his message that I posted above, it’s anyone’s fault but your own

No matter what is decided, I will leave behind all daniele sesta projects forever. What happened was completelelly unnaceptable. I got liquidated because Sifu was irresponsable. Thats it. Said it was safe but he himself trigered 14 million in liquidation rigth above us. And he is bragging about it on Twitter as if this was a huge sucess! Even if this turns out to be a huge succes I’d rather be poor for the rest of my life than to make it with you people. This shouldnt even be a vote (we wont count anyway!). The fact that people are blaming US for being GREEDY discusts me.

Your beloved treasury will surelly run out with the useless buybacks. The treasury is up for grabs. You think you’ll get “revenue share”? There is no amount of good deals that will keep this going.

We went from innovative defi ecossystem to crypto etf. You want a free-floating etf! The etfs i know have huge arbitrage banks pegging the etf to the assets they represent. You have a bleeding treasury.

The leveraged positions, behind the backing price, could have sustained high prices above the backing price. That’s how it got to 10k.

Its almost as if this was a settup. The loans should have been limited to a % of the backing price as this was the most obvious way to do it. They know how to do this with MIM-UST. But they allowed 90% borrowing! Omicron and senate hearings came and blew it all up, innitiating the cascade. Predatory whales smelled blood and are relentlessly trying to eat the treasury ever since. They will succeed

If most if not all holders had easy access to limited MIM loans this could have worked. Abra would be a wind blowing the price up. But only few huge loans were given creating instead a downwards mine-field.

You who are aggainst this proposal is so becouse you fear that this project is now doomed to fail. If you believed in it or understood the logic behind the original idea, if you were confident that it has a bright future, you would not mind an extra % of the treasury earnings or assets to compensate the people who trusted the project the most.

Instead, you are the greedy one clinging to “your precious treasury” because you know that it is about to evaporate soon.and you think that maybe if daddy Sifu has lots of coins he will make you break even eventually. Gues what, he blew his own wallet.

When a black swan event happens, its no longer a black swan. The next black swan will be worst. WW3 and the death of the entire multisig perhaps?

I believe the team is working hard for the investors. I understand there’s lessons learnt along the way. This has been flagged as a Black Swan event. I believe restoring leveraged investors collateral as good will that fell below the guaranteed backing promotes confidence in the community.

Moving forward the wonderland docs need to be updated to help clear up confusion as many believed we were protected by the backing price.

Many discussions taken place in discord are adhoc and often can be taken out of context. Discord can be a tool for dyor when making decisions before investing in a project, but to use it as a rebut on a adhoc conversion in a sea of other conversations just doesn’t cut it imo. The community shouldn’t have to scour social media for clarity on important information which should be presented in the documentation.

I’ve been in the project since early November.

My leverage was conservative at 60% health. It remained reasonably healthy due to the rebases even with the price falling. I don’t consider myself to be greedy. Unfortunately the liquidation event has also forced me out of the project.

Thank you, @NalX.

I understand people want to express their point of view, particularly those who were affected negatively by the event. However, I agree some are just re-stating their thoughts in a manner which might even be detrimental to the cause.

The RFC document was expanded to not only cover the issue of repaying the debt, but also other related topics such as:

- Reasoning on why this happened and ideas to prevent it in the future;

- Main arguments from both sides;

- Petition to Wonderland team for more detailed explanations (I think this specific point should be extremely important for all the community, not just the ones that were liquidated);

- Petition to Wonderland team to provide calculations of what % of the treasury repaying the liquidation would affect (it doesn’t make sense to vote without knowing if we’re talking about 1% of the treasury or 20%).

I believe in the DAO concept and in Wonderland/Frog Nation as a project. The fact that we discuss not only ideas but also challenges is incredibly healthy, to the point that Danielle himself agreed to promote this topic.

I hope this clarification helps people understand this is more than just a repayment proposal and definitely not just a “vent” forum.

If anyone want to contribute to a structured proposal, I can give you edit access:

This is very useful, thank you for giving it some thought and structure. I might want to contribute after we open the RFC and the team provides more details.

I think it’ll be a very hard issue to vote on if we don’t understand the impact on the treasury. Some frogs want to help, but not if the “cost” is too high.

Sir, if you want some edit access, it seems you have the passion representing alot of frogs who are feeling pain… let me know

If anyone want to contribute to a structured proposal, I can give you edit access

I absolutely agree… thank you fren, looking forward to your help in putting this behind us

…the two proposals I have drafted may be easier for all to accept… an NFT doesn’t affect the treasury…

…and surely there is some amount of the treasury, <1% for instance, that could be palatable to the community for some rebate to those who lost everything…

…actually, proposal for escrowed wMEMO rebate wouldnt affect the treasury at all either…

At no point did Sifu say that the price couldn’t go below backing. He actually made it explicitly clear the the price COULD go below backing before buybacks were able to be initated.

If you chose to ignore that risk, its on you and no one else. Why should the people who were risk averse pay for your risk taking? Its nonsensical.

These are the kind of things that confuse frogs and ultimately leave them hanging with the wrong expectations. Initially we were supposed to buy at backing price, then above backing price to prevent cascade, now below backing price.

We need to have a clear policy on this mechanism works and document it for everyone to be in the same page. This has been documented in the RFC. People can’t make financial strategies if we change our policies every week and the only notification is a post on Discord (20K users out of 300K wallets, which is roughly only 6%).

Of course the price CAN go bellow backing. I think no one is so stupid to imagine that it couldnt.

Its not about what he did or did not state. He is not George Constanza from Seinfeld who got fired for having sex with the cleaning lady inside the office, then stated that he didnt knew he couldnt do that. He is managing 1bilion+ funds and he didnt anticipate the risk for his own wallet. Thats where trust ends.

Everything can always happen. But when shit happens, you dont pretend like it was a victory and ignore the consequences. So I’m out. Never put more than I could afford to lose, good luck with this.

Like g_bcn just said. Not everyone is a “daytrader” to be able to spare hours everyday searching discord chat. He said a lot of things over the weeks, a lot changed too fast. Some people have real lifes, family, kids, jobs. Some people get sick.

It would be honnorable to admit his mistake and provide accountability. Acting as if we just have to “move along, nothing to see here” makes “frog nation TM” worst than the “suits” they so loathe.

Precicely because there is nothing writen that this couldnt happen that the responsability is greater. They dont want to have a legal entity or writen contratual rules? I hate those too. But not when i am dealing with irresponsable people who blame me for their mistakes.

Im not trying to bait for more bailout money. You could give us the whole treasury and the point would still be valid. This was a f*up and no one is taking responsability. Just like a 2 year old.

Sorry if this doesn’t help the cause. But this is an example of why im leaving. Too many people arguing that the liquidated are to blame for their “greed”. Ok pope Francis. Have fun with sports bets.