[RFC] - WTM - yieldchad

- Appoint yieldchad to TM with no/minor changes

- Appoint yieldchad to TM with changes

- Don’t appoint yieldchad

Name: [RFC] - WTM - yieldchad

Scope: Potential for yieldchad to become TM, including the structure of his role, his goals for WL, proposed investments, tenure, and compensation

Link to previous [DAO Discussion]: “[DAO Discussion] - WTM - yieldchad”

Objective: To finalize the proposal for yieldchad’s candidacy for TM

Provide a High Level Overview: I (yieldchad) have proposed to the DAO to serve as next TM. There are a number of outstanding questions regarding how I would serve in the role that need to be resolved. I will propose a solution and request comment from the community in order to finalize a proposal for WIP. To discuss:

- Background

- Why I’m Running

- Goals/Plans for Treasury

- Multisig Signer Role

- Portfolio Management

- Tenure

- Compensation

- Conclusion

Proposal (skip to #3 if you have already read DAO Discussion post)

1. Background

If you have already read the DAO Discussion post you can skip this section

Section removed/edited on 2023-08-28 due to privacy concerns from OP

My career has been a singular focus on investment and fund management. It’s what I love to do, what I’m good at, and what I am doing currently with my own fund.

2. Why I’m Running

If you have already read the DAO Discussion post you can skip this section

99% of projects facing the obstacles that WL has faced in the past year would not have survived. To do so proves WL’s resilience. Today, thanks to top class mods, an intelligent and dedicated community, and tactful stewardship, WL has laid the framework it needs to not only survive, but return to long-term growth.

It may sound corny but I love DeFi and investment management – it doesn’t feel like work to me. When I raised my fund last year, I chose this as my career path.

Because of this, I am in a unique position to be able to commit full time to WL treasury management and bring the strategies I develop for my fund to the benefit of the WL treasury. WL will benefit from my tradfi experience, DeFi knowledge, and strong crypto network, which allow me to deploy specialized, market beating investment strategies as well as partner with protocols across the space to create value for Wonderland.

3. Goals/Plans for Treasury

-

Create a motivated and highly responsive multisig (more detail in section #4)

-

Continue to push forward WIP’s to improve management and oversight of WL treasury through community governance. I will work hard to further strengthen an already strong WL governance process

-

Protect existing treasury value through high EV, low volatility investments

-

Partner with other protocols to unlock value for the treasury and wMEMO holders

-

Continue to hold redemptions or votes on redemptions in line with the Quarterly Redemption WIP, while ensuring redemptions do more to benefit long term wMEMO holders (or at least do not harm their interests)

-

Execute buybacks, at discretion of treasury team, when discount > expected annual return for the treasury

-

Institute revenue share from treasury yield - For the first revenue share, collect some discretionary portion of the income from August and September and send it to a rev share contract at the end of the quarter to be distributed over the following period until the funds for the next rev share are collected.

-

Always act 100% in the best interests of wMEMO holders

4. Multisig Signer Role

- A responsive and motivated multisig is key to investment performance. WL needs to add additional members to the multisig in order for the next TM to not be hamstrung in their process

- I suggest a multisig signer role so that the treasury is not dependent on waiting for TO or Treasury Team Member’s to join the multisig

[DAO Discussion] - New Role - Multisig Signer

5. Investment Strategy Overview

Key Principles:

- Preservation of Capital - defensive positioning during market uncertainty, with small allocation for selective, extremely high EV trades

- Increase value for wMEMO holders - buybacks and redemptions will be constructed such that value is delivered to long term holders

- Partnerships with other protocols - incentivize wMEMO liquidity cross chain and provide unique farming opportunities for treasury/wMEMO holders

- Use WL’s reach to acquire distressed treasuries at discounts

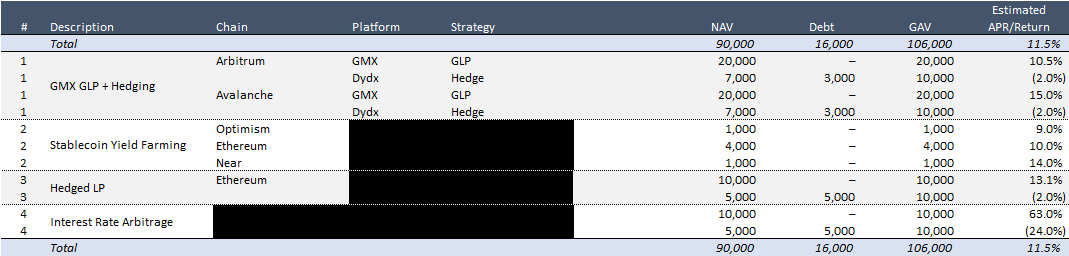

Detailed Investments:

-

Yielding Opportunities - The majority of the treasury will be allocated to low volatility yielding opportunities

- Hedged GLP → Please see my DAO Discussion post outlining the strategy here

- Hedged LP → Provide DEX liquidity for two volatile coins, and hedge the exposure with a short. There are highly liquid opportunities to provide hedged liquidity for volatile coins, not just Matic-MaticX

- Stablecoin Yield Farming → Some allocation will be made to safe stablecoin yield farms

- Interest Rate Arbitrage → Arbitrage differences between borrow rates and supply rates. There are other highly liquid opportunities besides the AAVE USDT strategy which I detailed here

- Options Arbitrage → Arbitrage differences in IV for different options across protocols. This is highly profitable during periods of high volatility, and less profitable during low volatility periods (which we are now in). Gamma and Delta can be hedged out completely using DeFi mechanics

-

Partnerships - WL stands to gain significantly from making protocol to protocol partnerships

- Sifucadabra → WL has a strategic, long-term interest in partnering with Sifu’s coming lending protocol, given the treasury’s large Sifu.vision holdings. It is in the treasury’s interest to support Sifu to the fullest extent possible

- Frax → In discussions with Frax team to create gauge proposals to incentivize wMEMO/FRAX pairs on multiple chains

- Velodrome → In discussions with Velodrome team to create VELO incentivized pools for wMEMO/stablecoin pair on Velodrome

- Inverse Finance → Inverse team is interested to facilitate a DAO-to-DAO loan, allowing for WL to borrow DOLA and farm DOLA-3Crv on Convex for 36% APR (likely to decrease) in a whitelist-only lending pool. Security is obviously a top concern and nothing will proceed without confidence, due diligence, and DAO approval. Borrowing DOLA and farming DOLA-3Crv is short DOLA exposure, therefore secured against bad debt in Inverse protocol

-

Distressed Treasuries - Use WL reach to partner with distressed projects, acquire their tokens, and set KPIs. If KPIs not met, liquidate tokens for treasury value. Tokens held at cost until during timeline for KPI realization

- Protocol 1 - Product is protocol pivot to liquidity as a service. Treasury ($10-90mn) is >6x market cap of the token. Have engaged team on potential for partnership with WL. Plan to buy significant quantity of token in OTC transaction, support team in marketing their new pivot project. If KPI’s not met, team will allow WL treasury to swap purchased tokens for treasury value near 1:1.

- Protocol 2 - Product is yield aggregator. Treasury ($5-30mn) is >6x market cap of the token. Have engaged team on potential for partnership with WL. Plan same as Protocol 1.

- Multiple additional similar protocols

Note on portfolio details: revealing the investment strategies in detail now risks alpha dilution. After my initial DD proposal, in which I detailed strategies in depth, the AAVE USDT-Short strategy was ruined as a third party came and borrowed $89mn USDT on AAVE, taking all available profits from the strategy and earning 17.5% apr if using 10x leverage. (I know from first-hand experience that there are dashboards tracking governance proposals that the top on-chain funds subscribe to for actionable alpha).

Sensitive details have been blacked out for the time being.

Suggested Portfolio Construction as of 12 July 2022

Assumed $90mn allocation to below strategies, with remainder of treasury allocated to Sifu, partnerships, or distressed treasuries

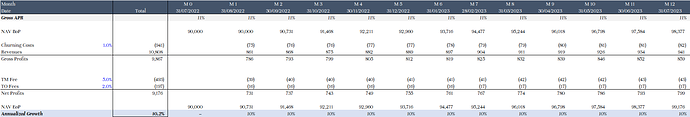

Portfolio Cashflow

6. Tenure

-

Initial term is a trial period starting from 23 July 2022 until 31 October 2022

-

Term be automatically renewed on a rolling six month basis if no WIP for alternative TM submitted 15 days before end of each term period

7. Compensation

- Base compensation (paid monthly on last day of month): $5k per month paid in USDC

- Performance fee (paid quarterly on the last day of the quarter):

- 5% of the gross profit of yieldchad Discretionary Investments;

- 2% of the gross profit of Existing Long Term Investments (BSGG, Sifu, etc);

- Less base compensation paid in the quarter.

- Gross profits used in performance fee calculations shall be equal to the increase in USD value of the corresponding investments (excluding fees) upon quarter end, subject to respective high watermarks

8. Conclusion

In surviving the controversies and volatility of the past year, WL has proven not only the resilience of its community, but the strength of the governance framework developed and maintained by its mod team, active community participants, and Sifu. Today, WL needs a new treasury manager capable of working with and strengthening the existing governance system in order to guide WL through the first true macro bear market since the invention of Bitcoin in 2008.

My background, network, and investment strategies make me well positioned to take on this role. My experience in private equity has made risk management the number one focus of my investment process - I will defend value in the wMEMO treasury. With a low volatility investment strategy and regular redemptions, wMEMO holders will see the value of their wMEMO go up over time. And through strategic partnerships with protocols like Sifucadabra and other projects with distressed treasuries, the WL treasury will see significant upside despite the bear market.

Since an RFC is a “work in progress” Proposal, not all of these points need to be filled out from the beginning. They can be added over time as the RFC evolves into a mature Proposal.