[WIP #20] - Treasury Advisor - yieldchad:

Name: [WIP #20] - Treasury Advisor - yieldchad

Scope: The position of Treasury Advisor and the election of yieldchad to that position. This proposal also further includes risk disclosures.

Link to previous discussions:

“[DAO Discussion] - Treasury Advisor - yieldchad”

“[RFC] - Treasury Advisor - yieldchad”

Objective: Finalize the role of Treasury Advisor, including: expectations, requirements, strategies, compensation, risks, and tenure.

Snapshot

to be added

Provide a High Level Overview: Yieldchad was recently elected to Treasury Manager. However, in order to reduce liability for the treasury and for yieldchad himself, it was agreed that yieldchad would withdraw from the TM position, and instead apply for an advisory role.

The Role

The idea of the Treasury Advisor is simple - the TA will look after treasury operations and advise on how to deploy the capital, while the relevant DAO representatives (potentially the Treasury Committee as laid out in WIP 15) makes the ultimate decision on whether or not to invest. Ultimately, the TA is expected to develop and suggest investment strategies, protocol partnerships, and generally look after the wellbeing of the treasury.

The TA will submit monthly reports detailing strategies deployed by the Treasury.

The role of TA will be similar to that of Treasury Manager, with a few key differences:

- Not on the multisig

- Not an executive decision making role – the Treasury Advisor will make recommendations which the multisig will decide whether or not to execute

The TA will be expected to:

- Submit investment proposals on a regular basis to ensure that the Treasury is deployed and earning returns

- Monitor existing strategies to ensure safety and performance

- Work with other protocols to scout partnership and unique investment opportunities with the Treasury

- Write monthly reports on Treasury activity

- Always fight for the best interests of wMEMO holders

Tenure

The TA will serve an initial term starting from the end of the snapshot vote (if elected) until 31 December 2022. If no proposal to replace or remove the TA is made by 15 December 2022, the Treasury Advisor’s term shall be renewed on a rolling basis thereafter for 6 month periods.

If the TA is deemed unnecessary by the community, the TA will resign before his tenure ends per the results of WIP voting to end his term early.

Strategies

As TA, I will suggest strategies similar to my proposal outlined here: [RFC] - WTM - yieldchad

Compensation

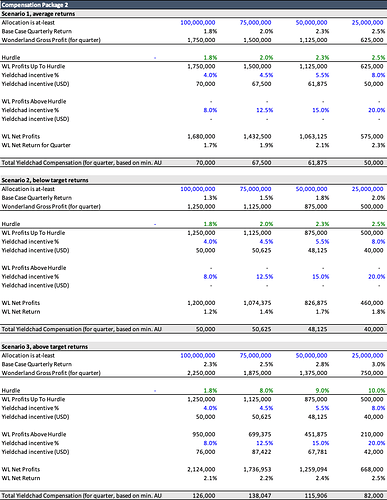

Total Compensation for the Treasury Advisor = Performance Fee - Base Salary

The Treasury Advisor will receive a base salary ($3,500 per month) which is deducted from a Performance Fee. Performance Fee will be calculated as the profits generated by any TA advised strategy during the quarter, as shown in the below excel spreadsheets. Profit calculations will be made from the earlier of the start of any strategy and 00:00 UTC on the first day of the quarter, and end at 23:59 UTC on the last day of the quarter. Payments for compensation will be made for the previous quarter on the first day of each new quarter. Payments will be made in USDC.

The allocation amount used shall be the time-weighted-average cost basis for new strategies, or value of strategy at the beginning of the quarter for existing strategies, for all strategies under the TA’s advisement.

Performance Fee will be subject to a quarterly high watermark calculation on advised strategies. The watermarks shall be calculated on TA advised strategies using the greater of the cost basis and the value at the start of the quarter. If the value of the funds under advisement drops below the high watermark, then the Treasury Advisor shall not receive the Performance Fee until the high watermark is reclaimed. The high watermark, after being reclaimed, will serve as the new cost basis for the profit calculations. For example, if the funds drop below high watermark in one quarter, and then rise above high watermark the next quarter, the TA will have to achieve a 2.5% return (assuming funds under advisement <$25mn) from the high watermark in order to hit the hurdle.

Compensation will be calculated on strategies advised by the TA, defined as any strategy which was submitted to a vote by yieldchad to the relevant DAO representatives, passed the vote, and was executed. Strategies advised by yieldchad before his potential tenure as Treasury Advisor will qualify as eligible for compensation only from the time period that yieldchad’s tenure as TA commences. Fair valuation of illiquid investments such as locked tokens shall be agreed between the TA and the relevant DAO representatives. If allocation under advisement is less than $25mn, it shall use the same hurdle and compensation rates as $25mn allocation.

The objective of the Compensation Package is:

- Ensure the Treasury Advisor receives compensation competitive with Tradfi

- Ensure the TA is still incentivized to manage the treasury in a prolonged bear market scenario

- Avoid obscene compensation in a bull market

The community has chosen the below compensation package based on feedback in the RFC proposal.

Compensation Package 2 - Hurdle - TA receives lower % of profits below hurdle rate, higher % of profits above hurdle rate

Risks and Disclosures

There are significant risks involved in cryptocurrency and decentralized finance investing. Thus this proposal includes risk disclaimers in order to better educate the community about risks faced by the WL Treasury:

-

Returns are not guaranteed by the Treasury nor Treasury Advisor. The Treasury Advisor may advise strategies which result in a capital loss for the treasury.

-

Purchaser Suitability. wMEMO should only be bought by token purchasers who understand the nature of the token, do not require more than limited liquidity in the token and have sufficient capital to sustain the loss of their entire purchase. This token is highly speculative and purchasing this token incurs significant risk for the purchaser. This token is designed only for sophisticated and experienced users who are able to bear the risk of loss of their entire purchase.

-

Illiquidity. There is no guarantee of liquidity for Treasury investments or the wMEMO token. Token holders as well as the Treasury may be subject to risks arising due to the illiquidity of digital asset investments.

-

Conflict of Interest. The Treasury Advisor may recommend the Treasury to invest in digital assets in which the Treasury Advisor holds a stake. The Treasury Advisor will disclose to the relevant DAO representatives such conflicts of interest when making an investment. The Treasury is generally subject to conflict of interests risk by those who manage the Treasury.

-

Lending Risk. The Treasury will utilize lending protocols and will act as a lender to counterparties and the relationship will be governed by a smart contract. Lenders of Digital Assets through DeFi protocols are at risk of losing their principal if a significant number of borrowers default. To the extent the Treasury purchases Digital Assets through De-Fi protocols, such Digital Assets are at risk of a total loss.

-

Decentralized Finance “DeFi” Risk. The Treasury will purchase digital tokens and generally participate in activities utilizing DeFi protocols. DeFi protocols and tokens are generally subject to many of the same risks applicable to other Digital Assets. Such protocols are also highly unregulated and subject to nefarious practices such as “rug-pulling,” “pump and dumps” and other trading schemes prohibited on regulated marketplaces. Additionally, because such transactions will involve instruments that are not traded on an exchange, but are instead traded between counterparties based on smart contracts, the Treasury may be subject to the risk that a counterparty will not perform its obligations under the related contracts. DeFi protocols are moreover subject to smart contract risk, governance attack risk, and other risks which may result in losses for the Treasury.

-

Staking Risk. The Treasury may stake assets for a variety of reasons, including earning a share of protocol fees, token emissions, or for other reasons as deemed appropriate by the Treasury. Staking digital assets incurs significant risks and may result in losses for the Treasury.

-

Custody Risk. The Treasury relies upon various multisignature wallets to custody the assets. There are significant risks associated with using a multisignature wallet, and the Treasury may be subject to a total loss of funds if the security of its multisignature wallet is compromised.

-

Regulatory Risk. The Treasury is subject to increasing risk of regulatory action against protocols such as Wonderland. Regulatory risk may result in losses for token holders or the treasury.

-

Tax Risk. The Treasury faces tax risk due to its unclear operational jurisdiction. Tax enforcement by various states may result in losses for the Treasury and its token holders. Token holders are furthermore subject to tax risk by holding holding, staking, or trading the token.

Other

Yieldchad will provide the advisory consultancy services via a corporate entity owned solely by yieldchad.