Thanks Shrop_99_Degen.

the Professor posted NEW,

Shorop_99_Degen wrote WL2.0+Professor

and a lot of discussion are on going at forums (Wonderland, Abracadabra etc).

i try to update my 001 by “reordering, deleting and adding”.

if possible, check and give me comments.

Gilgamesh @ Twitter.

[competitive advantages] >>>>>>>>>>>>>

<Professor_a1>. Large and passionate community

<Professor_a2>. Strong Brand: “Fuck the Suits”

<Professor_a3>. Prior success in other projects

→Defi Bank (Abracadabra)

→automated market maker/yield hunting platform ( Popsicle)

[Limone]: 1. Automates the process of identifying the most profitable yield farms for a given LP, allowing also leverage. 2. Compounds any rewards generated directly back into the LP to supercharge your returns.

[JIT(Just in time liquidity)]: 1. The blockchain is constantly monitored for large trades. 2. When a large trade (buy or sell transaction) occurs on Uniswap V3, liquidity from Popsicle Finance is deployed into a narrow tick range allowing us to capture almost all (99.9%) of the trading fees for this trade. 3. The liquidity for this trade is then automatically removed within a single block.

[Order Book Dex]

[Leveraged PLPs]: 1. An initial PLP is created by entering into a Univ3 pool or Limone Pool on Popsicle Finance. 2. Users are able to apply leverage to this PLP via using Abracadabra Money but using Popsicle Finance’s UI.

→decentralized exchanges (Sushiswap)

[highlight of success] >>>>>>>>>>>>>>>>

- Betswap: the DAO’s first investment has already netted a 500% return on investment within a one-month time frame.

- yield farming

→ switching TIME/AVAX pairs to TIME/MIM and wMEMO/MIM has helped secure profits as well as continue to keep liquidity for the TIME/wMEMO pair high.

→ received first preference on the UST-MIM leveraged stable farm (Degenbox) where $150 million was deployed to earn close to 120% APY with no directional risk (this has now been unwound).

→ managed to lock voting power for their CVX purchase at more than double the APR that everyone else would be receiving.

→ the timely Avax OTC swap made with Alameda on the eve of the early December crash which saved the DAO ~$10 million

<<<<<<<<<<<<<<<<<<<<<<<<<<<

]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]

Professor_Phase0: Raging in Wonderland. ]]]]]]]]]]]]]]]]]]

]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]]

OLD: Professor_c04. Allow a Rage Quit Solution.

— Allow Rage Quitting for those that want to exit by locking trading for 48 hours, then burn tokens to increase the price well above backing. Win-win for both sides.

— Implement anti robot technology to prevent bots from gaming the system and our own bot for automatic buybacks to protect backing price but only for the short term.

[Professor2]

- Shut down all trading and remove LP liquidity effective immediately.

- Have the Wonderland Team provide a clear calculation around the backing per wMEMO that rage quitters would receive. In the calculation, they should provide: wMEMO = Treasury Value / Non-DAO Supply.

- Allow a 48 hour window for rage quitters to claim. Airdrop all BSGG tokens to everyone during this 48 hour window.

- Once the rage quit swap has been concluded, shut down the LP and trading for another 2–3 weeks until new management is appointed to take over and the path forward is clear.

- Prior to reopening the LP, the DAO will burn all wMemo tokens from the rage quit swap and any other DAO owned tokens management sees fit to decrease circulating supply and have an effect on lifting price above backing.

////////////////////////////////////////////////////////

WL2_Phase1: Govern ////////////////////////////////////

////////////////////////////////////////////////////////

- WL2_P1_01: Responsibilities ++++++++

— we need to make clear what has to by ran by the DAO and which decisions can be made by the team.

- WL2_P1_02: Voting procedure ++++++

— for the things that need to go by the DAO we’ll have to implement a strict procedure that details how we go from idea to implementation.

- WL2_P1_03: Community engagement +++

— we’ll need to clean up the forum and be more strict in forum moderation.

- WL2_P1_04: Voting weights ++++++++++

— we have to make some adjustments to voting itself. Votes get dominated by the large players, we want to move to quadratic time-weighted voting to give the little frogs a louder voice.

///////////////////////////////////////////////////////

WL2_Phase2: Engage ///////////////////////////////////

///////////////////////////////////////////////////////

- Professor_c01. Scrap wMEMO and replace it with only one token.

— Transition to a one token protocol. [Gligamesh01]SIMPLE/Education.

<1> The Professor recommends just one that receives a monthly airdrop of earned revenue. This does not make sense to me. Every revenue sharing token/protocol requires staking which gives you a new token in exchange. Abra, Curve, Convex, etc.

<2>The 2.0 proposals makes more sense. It offers the gMEMO (governance token), which has a capped supply, and the wSHARE (revenue staking token), which has a dynamic supply. The wSHARE token is received in exchange for staking your gMEMO in the revenue share.

- Professor_c02. APY vs Revenue Share

— Kill the APY, change tokenomics to a capped supply of tokens, move to revenue share model where to qualify investors need to hold for 30 days.

**[Gilgamesh02]**→ With an APY of 10000000 or an APY of 0, at the end of the year your percentage of the treasury will still be the same.

— Revenue Sharing

<1>The Professor suggest just air dropping MIM to the 1 token for the DAO. This would be much different that any other revenue sharing protocol like Abracadabra, Convex, Curve, etc. which require staking and a receipt token.

<2>The 2.0 proposal offers two different pools for staking your gMEMO.

[MIM Dividend Pool]: wSHARE is converted to MIM. These will be automatically pushed to the end-user once a user-defined threshold is reached (depending on gas sensitivity).

[wSHARE Compound Pool]: the wSHARE is converted back into gMEMO through buybacks on a linear basis over 180 days. The user can recover any amount of unconverted wSHARE at any time through the staking contract but will pay the performance fee on that amount as per the chart below.

<3> Shrop_99_Degen recommend just one compounding pool.

[Revenue share % details] to be decided by DAO

[Minimum Stake period] to be eligible revenue share?

- Professor_c06. No Leverage

— Abolish all leverage, especially if rebases aren’t cut.

— No bail out for people that were liquidated with Treasury funds.

You live by the sword, you need to accept dying by the sword.

It is up to Dani if he wants to compensate these people from his own funds.[Gilgamesh03] → shouldn’t stop Leverage if can control it.

{RFC — Abracadabra Community-Focused Liquidation Mechanism}

Anchor Protocol 20 on Terra recently implemented this style of liquidation queue, and it’s changed the game for both the network and the community. Kujira ’s product ORCA is the first dApp on any chain allowing users to bid on liquidated collateral using an intuitive UI, with absolutely no technical know-how required.

- Professor_c09. Beware of Sharks.

- Professor_c05. Monthly Audits, Treasury Dashboard and Backing Price

— Create a clean Treasury Dashboard showing assets held, current cash flow and P&L and clear metrics of total circulating supply vs DAO owned supply.

- Professor_c08. Education & Support

— Create an education platform for investors with video content with FAQs and How-To’s so that the Discord channel and AMAs don’t get clogged with these types of questions.

////////////////////////////////////////////////////

WL2_Phase3: Strategy ///////////////////////////////

////////////////////////////////////////////////////

[Professor2]=[Shrop_99_Degen]=[Gilgamesh04]

- an oversight committee is not needed; The management team should be able to execute as they need to (taking into consideration the suggestions of the DAO).

Professor_c03. Management Structure

— Keep Dani on as CSO (Chief Strategy Officer) and free him up from Treasury Management to maximize his strengths.

— Restructure management, bring in a COO, CFO, Treasury Managers, Investment Manager, Communications Director/Risk Manager and other external consultants. If we are truly to grow, there needs to be a larger team helping to push it forward.

→[One of the proposals ]

+Bastion Trading / TheSkyhopper to manage or advise on Wonderland Treasury

/////////////////////////////////////////////////////

WL2_Phase4: Grow ///////////////////////////////////

/////////////////////////////////////////////////////

Professor_c07. The Merger

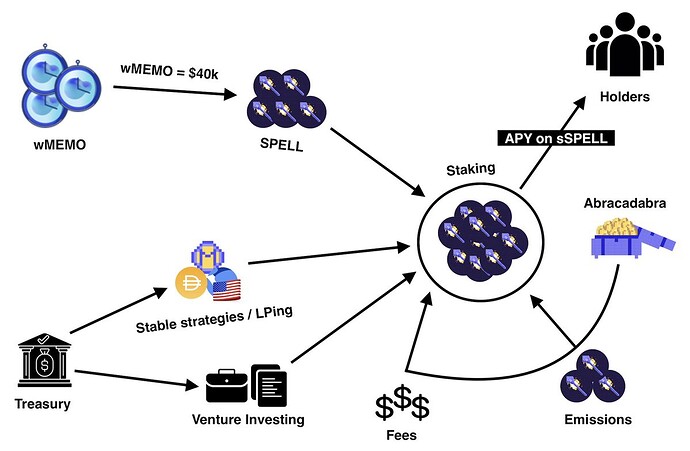

— In $SPELL, to have Abracadabra own the majority of the MIM liquidity and not need to be exposed the mercenary liquidity, which will increase price pressure for the Spell token.

— In $wMEMO[=speculative ex1.excited seeing rebase, ex2.early stage VC],not to be interested in waiting around for a year for the token to double or triple in value.

[proposals ]

-

AIP #7: Expecto Patronum: A shield for all frogs ← A-Train’s proposal.

-

AIP #6: Frog Nation: A bold idea potentially becomes the biggest thing Crypto and DeFi have ever seen.

kr4chinin’s twitter.

- ve(3,3): SOLIDITY

Process flow;

Step 1: Create a pool with 2 assets, either stable or volatile, this can be done via the BaseV1Router01.addLiquidity

Step 2: Add a gauge to the pool you just created via BaseV1Voter.createGauge

Step 3: Vote for the pools which you would like to incentivize through Solidly via the BaseV1Voter.vote

Token emission will start 2 weeks after the deployment of the Solidly ecosystem, as can be reviewed on BaseV1Minter

The projects receiving the veNFT’s will own 25% of the protocol in perpetuity, this % will remain fixed, as can be reviewed in ve-distribution

From there only two things to do (optionally) weekly;

- Claim % emissions via ve-distribution.claim

- Claim fees via BaseV1Minter.claimFees

Deployment will occur as soon as the all project details have been received and the last pending audit has been finalized and published.

For integration, please review the testnet addresses as found here

For documentation, please refer to the github found here

To run locally, simply git clone > npm install > npx hardhat test

- SOLIDITY-distribution

Abracadabra:0xb4ad8B57Bd6963912c80FCbb6Baea99988543c1c 642992

SushiSwap:0xF9E7d4c6d36ca311566f46c81E572102A2DC9F52 609195

Morpheus Swap:0x9685c79e7572faF11220d0F3a1C1ffF8B74fDc65 536754

Fin.