I’m ok with not attracting people who only chase APY. That’s not the long term purpose of this DAO and shouldn’t be the focus of long term holders. Rebase will eventually go away and be replaced with revenue sharing.

*Irresponsible (9,9)ers

Like it or not, people chasing APY make up a significant proportion of the current holders. I am optimistic about Sifu’s portfolio management capabilities but realize that even achieving a 1000% APY will be quite incredible. Adding an incentives program could benefit us greatly by helping retain holders.

Shouldn’t owning Time be the incentive? What are the Future use cases. Didn’t Dani say they’re developing an rpg?

Spend any amount of time on the discord general chat and you will realize that a lot of people jumped in without knowing what the project was all about. They saw the high APY and expect it to last for at least a year. Holding $TIME would probably not be enough of an incentive

It’s not about a punishment for make the withdrawals, it’s about give additional rewards to stake on long term

I don’t think rebase hopping is an issue. Liquidations caused the steep drops and Sifu is working on a solution.

But what could have set off those cascading liquidations? Whales hoping off to avoid a downtrend?

Firstly, thank you for starting this discussion since many people are/were probably very nervous due to market dipping, and discussions such as these can ease the nerves.

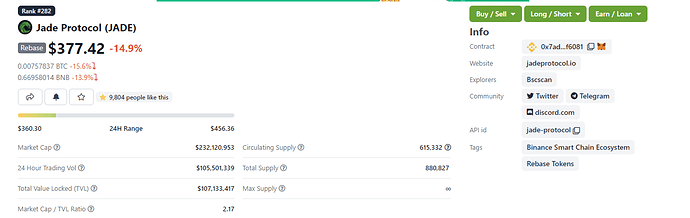

But I don’t think airdrops will help. Didn’t help Jade price either, as shown below.

Regarding the other suggestion of “locking the amounts for certain period before they can be claimed”.

I am also against it as this could ward of new potential investors.

No, Bitcoin dipped and so did TIME. At every price point of TIME going down, there were apparently hundreds more degens just waiting to be liquidated, leveraged to the gills. As the price dropped more from those first liquidations, the next group who were a tiny bit less degenerate got liquidated also. It cascaded down from high-grade idiots to hit even people with reasonable leverage. As the price kept dipping past that, some were finally able to shore up their loans or de-leverage.

Rebase hopping has never really been a thing at all. Leverage is what fucked us up. There should be 50 proposals in here to get rid of WMEMO but instead we have this fake issue.

Also- don’t actually get rid of WMEMO- I’m just saying yolo leverage nonsense is the real Boogeyman if you need one. Lol.

Agreed, over leveraging is a big problem and should be addressed. However, It has been proven that whales hopping and side-stepping around a rebase is a thing so I wouldn’t label it a ‘fake issue’. People are doing this despite claims that ‘the slippage cost would be prohibitive’: Address 0x6dae3f488035023cf7df5fa51e685c3b3cbe50d7 | SnowTrace

There are streamers around that are promoting this behavior and it is gaining in popularity.

I just don’t see the downside to providing incentives for long-term holders. There are various ways to implement it without hurting the treasury. NFTs for example or maybe further discounts on mints to encourage people to mint more.

SIFU has directly addressed rebase hopping and dismissed it as an issue. Do you believe he is wrong?

Airdrops are a great way to incentivize long term stakers. However, there are significant risks with dilution, so I am not in favor of them. I prefer to keep the APY high instead and locking rebases to dis-incentivize the rebase hoppers. Love to the author who brought the proposal.

Not that I don’t believe him but I think he is overlooking the fact that it is quite profitable to side-step following a rebase during a downtrend. Whales can take the rebase and then sell off which offsets the transaction and slippage costs. This causes selling pressure and triggers those liquidations. They can then buy back more $time at a lower cost and accumulate more $time compared to someone that just held the rebases.

It is only unprofitable to side-step during an uptrend or if $time is moving sideways and that is the reason why you aren’t seeing that many wallets selling off for the past few rebases.

AIRDROPS sadly aren’t the solution.

This is my idea to incentivize the holding of TIME, i suggest this kind of solution:

Lets suppose that right now the APY is 70k% so any new entry stakers will start with this APY.

If you have strong hands each month of staking you will recive an INCREASED OFFSET % of APY that will be added to the variable standard APY.

Here some examples, (written numbers are only indicateve to explain the concept):

- ex. right now APY = 70k%

- 1 month staked in. TOTAL APY = 70K% APY + 1K % APY

- 2 month staked in. TOTAL APY = 70K% APY + 2K% APY

- 3 month staked in. TOTAL APY = 70K% APY + 3K% APY

- and so on for the next month

As you all know APY fluctuate during passage of time and tends to decrease. So the strong hands staker will preserve the highest APY in comparsion to those that prefer to trade instead of staking.

As soon as you unstake even partially the staked TIME your APY will go back to the base APY, in our previous example that would mean 70K% without EXTRA ADDITIONAL APY.

This solution will solve any kind of selloff that could be caused by airdrops or locking time solutions.

I think that some safe guards should be put into place on Abracadabra to keep people from carelessly borrowing against Memo. Liquidations are really the problem for the negative price action. Either Memo should no longer be allowed to be leveraged against, or there should be some limits on Abracadabra. That’s the main problem as far as I can tell.

The incentive is 10% in tokens every 5 days and a leadership team of whales, one of which is doxxed, who have a vision to change finance.

I’m with you 100%! I really think that one of the biggest upsides of this project is the sustainability of the APY. Having this as a slow & steady strategy (funny to say slow, considering the APY, I know) I think it’s what we should be focusing on. None of these AIRDROPS or some other rewards actually makes sense.

I would love for Wonderland to be different than any other DAO, & we can do that by being simple & efficient! There is a lot to build on this fundation!

But isn’t SIFU talking about stopping the distribution (APY) altogether? And changing the model to profit sharing where stakers get a (TBD) portion of the treasury based on how much they have staked?

I thought this was the latest news…

Definitely keep WMEMO. Regardless of what happens, I want there to be a wrapped option for the potential tax benefits (I’m in USA).